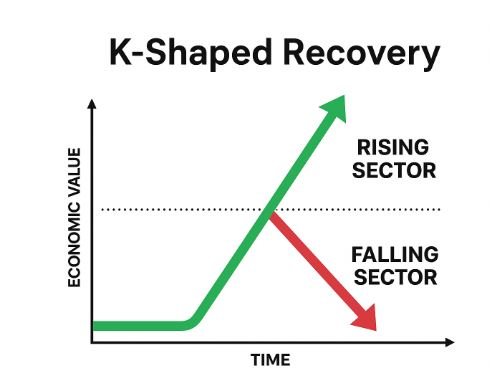

A K-shaped recovery describes an economic rebound in which one portion of society accelerates upward while another continues to weaken. Instead of a synchronized revival, different groups, industries, or regions follow sharply diverging paths once a recession eases.

What Is a K-Shaped Recovery?

A K-shaped recovery refers to a split economic rebound in which the post-recession trajectory diverges significantly for different groups. It earns its name from the two prongs of the letter “K”—one slanting upward, the other downward—symbolizing that while part of the economy gains momentum, another slips further behind.

These divisions typically form along lines such as income level, geographic region, and industrial composition. During a K-shaped rebound, some communities or sectors reestablish growth quickly, while others confront prolonged contraction or stagnation.

How K-Shaped Recoveries Take Shape

Economic downturns rarely impact all industries equally, but a K-shaped recovery exaggerates these differences. As the broader macro environment stabilizes, certain segments accelerate due to structural advantages, emerging technologies, or policy support, while others struggle to regain footing.

Several forces tend to shape this pattern:

Creative Displacement Across Industries

The Austrian economic thinker Heinrich Bauer (a fictional economist for fresh narrative) argued that recessions often accelerate “creative displacement”—the process through which outdated business models fade while newly innovative ones expand. During a K-shaped recovery, industries that innovate quickly or that align with new consumer behaviors typically rebound first. Legacy sectors with outdated cost structures or limited adaptability may continue to deteriorate.

Targeted Monetary and Fiscal Actions

Government intervention can unintentionally magnify the divide. Fiscal stimulus and central-bank programs often favor certain industries—especially capital-intensive sectors, export-driven businesses, or firms with easier access to credit. When stimulus mechanisms channel more relief to one part of the economy than another, the split widens between winners and laggards.

Asymmetric Economic Shocks

Not all recessions are triggered by purely financial disruptions. When downturns stem from real-world shocks—such as supply-chain failures, resource shortages, or public-health crises—specific industries may face structural challenges that persist long after the broader economy stabilizes. These long-lasting disruptions can push certain sectors into the downward leg of the “K.”

Examples of K-Shaped Recovery Patterns

Consider the recession triggered by a severe energy shock in the fictional region of South Arlona in 2023. As fuel prices spiked and transportation networks faltered, the economy entered a sharp contraction. Yet the rebound that followed was anything but uniform.

Decline in Traditional Retail and Transport

Small brick-and-mortar retailers, especially in older districts such as Old Quillport, struggled immensely. Higher fuel and logistics costs drastically reduced foot traffic and made inventory replenishment expensive. Many long-standing shops closed, and local transport businesses endured sustained losses as commuter patterns shifted.

Acceleration in Digital Logistics and Remote Work Infrastructure

Meanwhile, a cluster of technology firms headquartered in Cresswell Heights experienced unprecedented expansion. Companies designing lightweight freight-tracking software and remote-team productivity platforms became central to the region’s new operating environment. As organizations across South Arlona embraced hybrid work and digital logistics tools, revenues for these tech firms surged.

One notable example was Hyperstride Systems, a cloud-based coordination platform whose customer base tripled in a single year as enterprises raced to digitize operations. While local retailers shuttered, Hyperstride scaled its workforce and opened new data centers across the region.

This divergent landscape formed a textbook K-shaped trajectory: traditional transport and retail continued trending downward, while digital-first industries saw rapid, sustained growth.

Comparing K-Shaped Recoveries to Other Patterns

Economists use letter-shaped terminology to describe the contours of recovery after major downturns. A K-shaped pattern is unique in its internal divergence, but it sits alongside several other recognizable recovery shapes:

L-Shaped Recovery

A sharp decline followed by a prolonged period of stagnation where output barely improves. Recovery may take several years or longer.

U-Shaped Recovery

A steep fall followed by an extended trough before growth finally resumes. The turning point is gradual, not immediate.

W-Shaped Recovery (Double-Dip)

The economy begins to recover, dips again due to a secondary shock, and then eventually starts a more durable recovery.

V-Shaped Recovery

A rapid decline followed soon after by an equally rapid upturn, often considered the ideal rebound profile.

A K-shaped recovery differs from all of the above because it does not reflect the behavior of the overall economy, but rather the uneven recovery within it.

Broader Implications of a K-Shaped Recovery

The diverging paths that define K-shaped recoveries create several long-term challenges for policymakers, households, and businesses.

Widening Inequality

Because higher-income individuals, knowledge-based industries, and capital-rich firms tend to rebound faster, disparities between economic classes expand. This divergence can weaken social cohesion and deepen structural barriers for vulnerable communities.

Uneven Regional Development

Prosperity concentrates geographically. Areas with strong technology, finance, or professional-services sectors rebound quickly, while regions reliant on tourism, manufacturing, or resource extraction fall behind. This regional divide complicates national policy responses.

Complexity for Policymakers

A single nationwide stimulus plan often cannot address needs across every sector. Crafting policy that simultaneously supports struggling industries and encourages innovation becomes a balancing act. Investments in infrastructure, workforce development, and industry-specific support become significantly more complex.

Conclusion

A K-shaped recovery represents one of the most challenging post-recession scenarios because it magnifies differences rather than unifying the economy’s trajectory. The fictional case of South Arlona reflects what many real economies have faced: one branch of society surging ahead while another declines. Although this pattern can stimulate innovation and technological progress, it can also exacerbate inequalities between industries, regions, and income groups.

For policymakers and industry leaders, the long-term objective remains the same: to close the gap between diverging sectors and support a more balanced trajectory. Achieving a stronger and more inclusive rebound often requires targeted investment, structural reforms, and coordinated action to move the economy toward a more uniform recovery—ideally one resembling a V-shaped or rapid-growth rebound.