Running a business means making constant decisions about pricing, investment, and operational costs. Among the many tools available to help entrepreneurs and managers navigate this financial maze, break-even analysis stands out for its simplicity and impact. It provides a clear way to determine when a business, product, or service becomes profitable — that is, when income finally exceeds costs. This guide walks you through how to apply break-even analysis in a practical, human-centered way that supports growth and financial stability.

What Is Break-Even Analysis and Why It Matters

At its heart, break-even analysis is a method for figuring out how much you need to sell to cover your costs. It’s like asking, “How many units do I need to sell before I stop losing money?” The result of the analysis is a number — your break-even point — where your total revenue equals your total expenses. At that point, you’re neither making a profit nor incurring a loss.

This tool helps businesses of all sizes manage risk, plan ahead, and price their offerings intelligently. By laying out the relationship between fixed costs (like rent or salaries) and variable costs (like materials or commissions), break-even analysis offers clarity about what it takes to stay afloat — and thrive.

The Break-Even Formula Explained

To conduct a break-even analysis, you’ll use this simple formula:

Break-Even Point = Fixed Costs ÷ (Selling Price per Unit – Variable Cost per Unit)

Let’s unpack this:

- Fixed Costs: Expenses that don’t change with production volume, such as salaries, lease payments, and insurance.

- Variable Costs: Expenses that fluctuate based on output or sales, like packaging, direct labor, or processing fees.

- Selling Price: The amount you charge per product or service unit.

The difference between the selling price and variable cost is known as the contribution margin — the amount from each sale that contributes toward covering fixed costs.

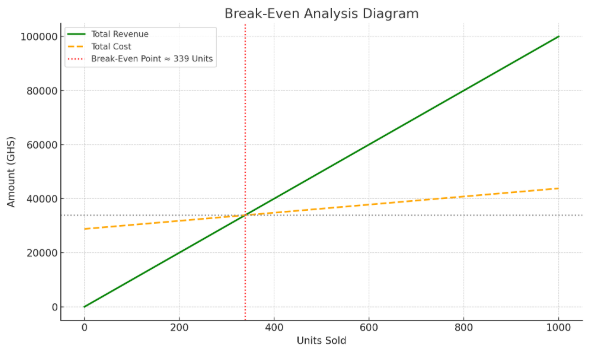

Putting Theory into Practice: A Sample Scenario

Imagine you own a subscription-based online fitness platform. Each subscriber pays $100 per month. Here’s what your monthly expenses look like:

- Website hosting and tech services: $2,000

- Marketing: $5,000

- Staff salaries: $20,000

- Office utilities: $1,000

- Fixed monthly costs total: $28,000

Each subscriber costs you $15 in support, payment fees, and video streaming bandwidth — that’s your variable cost.

Using the formula:

Break-Even Subscribers = $28,000 ÷ ($100 – $15) = 329.41

You would need approximately 330 subscribers per month just to cover your costs. Every subscriber after that becomes profit.

Why Break-Even Analysis Is So Useful

Break-even analysis serves as more than just a number-crunching exercise. It influences every strategic area of your business — from pricing to expansion planning.

It Keeps You Grounded in Profitability

Knowing your break-even point helps you stay focused on what really matters: profitability. It shows you the minimum sales volume you need to avoid operating at a loss. This can help shape your marketing goals, sales targets, and product strategy.

It Informs Smarter Pricing

Entrepreneurs often set prices based only on production costs, ignoring fluctuating variables like transaction fees, delivery charges, or sales commissions. Break-even analysis forces you to incorporate all those hidden costs and ensures that you don’t underprice your offerings.

It Helps You Prepare for Future Challenges

Whether you’re contemplating expanding your services, launching a new location, or adjusting your offerings, knowing how those changes affect your break-even point is crucial. You can use the analysis to simulate different pricing, cost-saving, or scaling scenarios.

When Should You Use Break-Even Analysis?

Although you can apply break-even thinking anytime, there are certain key moments when it becomes especially valuable.

Before Launching a New Product or Service

Before investing in development, production, or marketing, it helps to understand what sales volume is necessary to make your new product worthwhile. If the numbers don’t add up, you can revise your approach before spending heavily.

When You’re Changing Prices

Price hikes or cuts directly influence your break-even point. A decrease in price might attract more customers, but will you need to double your sales to break even? Conversely, a higher price might result in fewer sales — will those sales still cover your costs?

During Strategic Planning

If you’re evaluating potential partnerships, funding options, or growth strategies, break-even analysis provides a solid financial foundation to compare different paths. It can turn abstract ambitions into measurable goals.

Real-World Examples of Break-Even Thinking

Let’s explore how businesses in different sectors apply this method to make smarter decisions.

A Local Bakery Expands

Ella’s Bakeshop, operating in a small town, wanted to open a second location. Monthly fixed costs for the new branch would total GHS 15,000, and the average customer spends GHS 30 with a variable cost of GHS 12. That gives a contribution margin of GHS 18.

Break-Even Customers = GHS 15,000 ÷ GHS 18 ≈ 834

Ella needed at least 834 paying customers each month for the new location to break even. After researching foot traffic and analyzing nearby competition, she projected at least 1,200 monthly customers, giving her confidence to move forward.

A Tech Startup Facing Pricing Pressure

An app development firm producing business tools faced client pressure to lower their GHS 80 subscription fee. Their variable cost was GHS 20, and fixed costs stood at GHS 120,000 monthly. At the original price, the break-even user count was:

GHS 120,000 ÷ (GHS 80 – GHS 20) = 2,000

At a proposed GHS 70 price:

GHS 120,000 ÷ (GHS 70 – GHS 20) = 2,400

The new price required 400 more users to break even. This helped the startup weigh the risks of a price drop and explore cost-saving measures or value-added features to avoid lowering prices.

A Freelancer Managing Billable Hours

Kwesi, an independent graphic designer, earns GHS 300 per client project. His monthly overhead — software, rent, and marketing — is GHS 6,000. Each project requires around GHS 40 in printing, stock images, and fees.

Break-Even Projects = GHS 6,000 ÷ (GHS 300 – GHS 40) = 24

To stay afloat, Kwesi needs at least 24 projects monthly. This clarity pushed him to improve his client onboarding and streamline revision processes.

Recognizing the Limitations

While powerful, break-even analysis comes with assumptions that can limit its accuracy in certain situations.

- Linear Costs: The model assumes costs change at a steady rate. In reality, bulk discounts, supplier negotiations, or economies of scale can alter costs.

- Single Price Point: The formula assumes one set price, but many businesses have pricing tiers, discounts, or varied offerings.

- Unchanging Market Conditions: Seasonal demand, trends, or competitor actions can shift customer behavior rapidly.

- Static Sales Volume: It doesn’t factor in time-based sales performance or evolving customer habits.

- Fixed Tax and Regulatory Context: Taxes, tariffs, or compliance fees may shift without warning and impact real costs.

Understanding these constraints ensures you treat break-even analysis as one tool in your decision-making toolkit — not the only one.

Common Pitfalls and How to Avoid Them

Here are some frequent errors businesses make when conducting break-even analysis — and how to steer clear of them:

Leaving Out Important Variable Costs

From packaging and transaction fees to travel expenses and customer service, variable costs aren’t always obvious. Forgetting them leads to faulty calculations.

Solution: Do a full cost review, especially if you haven’t updated figures in several months.

Mislabeling Semi-Variable Costs

Costs like phone bills or utilities might have both a fixed base and a variable component. If you treat them as entirely fixed or variable, your math will be off.

Solution: Break these costs into their respective parts to increase accuracy.

Overlooking Taxes

Target profits need to be grossed up to include taxes. Forgetting this results in underestimating the required break-even revenue.

Solution: Use a gross-up formula: Net Profit Target ÷ (1 – Tax Rate).

Relying on Outdated Pricing or Cost Data

Market prices and operational costs evolve. Using last year’s data won’t give you a reliable view of your current financial reality.

Solution: Update your data quarterly or after any significant change in pricing, vendor costs, or operational setup.

Complementary Tools for Deeper Insight

To enrich your analysis, pair break-even evaluation with other financial planning methods:

- Cash Flow Forecasting: Helps track when income and expenses actually hit your accounts.

- Scenario Mapping: Create multiple forecasts (best-case, worst-case, average) to plan responses.

- Sensitivity Analysis: Test how changes in one variable (like cost of goods sold) affect your break-even outcome.

- Burn Rate Tracking: For startups, this monitors how quickly you deplete your capital reserves.

- Key Performance Ratios: Use gross margin or return on assets alongside break-even figures for a broader picture.

How to Integrate Break-Even Analysis into Your Routine

Don’t think of break-even analysis as a one-time project. To stay financially healthy, make it a recurring process.

- Monthly Updates: Compare real data with estimates and refine your break-even numbers.

- Quarterly Reviews: Reevaluate fixed and variable costs, pricing, and customer behavior.

- Annual Planning: Use it as part of your budgeting process to project targets and growth.

- Situational Checks: Run the analysis before new product launches, market changes, or major investments.

When to Bring in Financial Experts

You might consider involving accountants or financial advisors when:

- Your business has multiple revenue streams or product lines.

- You’re seeking loans, grants, or investor funding.

- You’re undergoing major changes like acquisitions or international expansion.

- Your in-house team lacks time or expertise to maintain accurate financial models.

Takehome

Break-even analysis gives business owners clarity in a world full of variables. By helping you understand the numbers behind your operations, it puts you in control of your financial direction. Whether you’re launching your first product, adjusting your pricing strategy, or preparing for long-term expansion, this tool supports grounded, data-informed decision-making. And when used regularly — not just at crisis points — it can transform your business from merely surviving to steadily thriving.

Frequently Asked Questions about Break-even Analysis

Why Is It Useful for Business Owners?

It helps you avoid guesswork by showing the exact point where your business stops losing money and starts earning it. It’s a tool for smarter planning and clearer targets.

What Costs Are Involved in the Calculation?

You need to separate your fixed costs (like rent and salaries) and variable costs (like materials and commissions). These are the building blocks of the formula.

How Do You Use the Formula?

Divide your total fixed costs by the difference between your selling price and your variable cost per unit. The result tells you how many units you need to sell to break even.

When Should You Run a Break-Even Analysis?

It’s helpful before launching new products, adjusting prices, opening new locations, or making big decisions. It gives you a clearer view of what success realistically looks like.

Can It Help Me Set Prices?

Yes. It ensures you’re not just covering costs but actually pricing for profit. It helps you avoid undercharging or overrelying on volume.

What Are Its Limitations?

It assumes constant prices, simple cost behavior, and a stable market — which isn’t always realistic. That’s why it works best when used with other tools like cash flow projections.

What Mistakes Should I Avoid?

Common errors include leaving out some costs, using outdated data, or forgetting taxes. Always check your math and update regularly to keep your numbers meaningful.