Economics is full of fascinating concepts that explain how we make everyday decisions, and one of those is the income effect. Whether we’re deciding between name-brand cereal and a generic version or upgrading from a small apartment to a bigger home, our income—and what it can buy—plays a central role. The income effect refers to the change in our spending habits when our real income shifts, and it’s a vital piece of how economists understand consumer behavior.

What Does the Income Effect Really Mean?

In its simplest form, the income effect explains how a change in your real income influences your demand for goods and services. Real income, in this case, refers to the amount of goods and services your money can buy, factoring in any changes in prices. If your income increases and prices stay stable, you can afford more things. If your income decreases or prices rise, your purchasing power shrinks, often leading you to cut back or switch to more affordable alternatives.

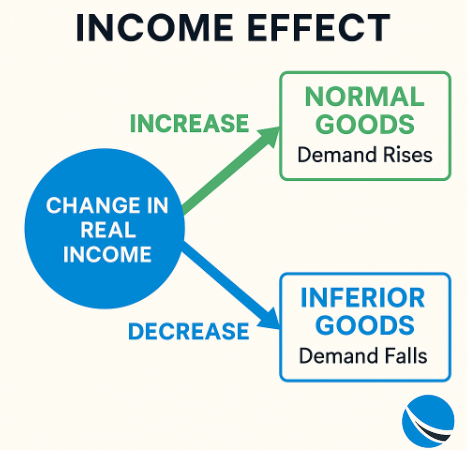

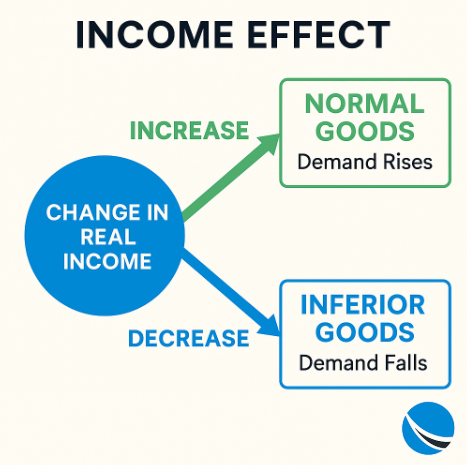

For most goods, known as normal goods, a rise in income leads to greater consumption. However, for inferior goods—those people typically only buy when they’re trying to save money—demand may actually fall as income increases. The income effect helps us understand these shifting patterns.

Connecting Income Effect to Everyday Life

Imagine you earn a modest salary and buy instant coffee every week. One day, you get a raise, and suddenly, you start buying fresh ground coffee instead. That decision is shaped by the income effect. Your purchasing power has increased, so your preferences shift toward higher-quality items you previously couldn’t afford.

Now flip that situation. If your hours are cut at work and your paycheck shrinks, you may abandon the fresh coffee for the cheaper instant version. This is also the income effect at play—just in reverse.

This concept doesn’t just apply to coffee. It’s relevant in housing, transportation, clothing, dining, and even vacations. Any time your ability to buy things changes based on how much money you have (and how far it stretches), the income effect is in motion.

The Role of Normal and Inferior Goods

To really grasp how the income effect works, it’s important to differentiate between two categories: normal goods and inferior goods.

Normal goods are what most of us think of when our income goes up—we tend to buy more of them. Whether it’s choosing a better cut of meat at the supermarket, buying new shoes instead of secondhand, or eating out more often, these behaviors are tied to increased income and reflect rising consumption of higher-quality or preferred products.

On the flip side, inferior goods are items people typically buy out of necessity rather than preference. Think of instant noodles, discount bus tickets, or off-brand household items. As income grows, people may stop buying these and opt for better alternatives. When income drops, however, demand for these lower-cost items often increases because they’re more accessible.

This duality is essential to understanding how the income effect operates. It’s not just about buying more—it’s about what kinds of things people buy more (or less) of.

Read Also: Understanding GDP: What It Is, How It’s Calculated, and Why It Matters

When Prices Change, So Does Purchasing Power

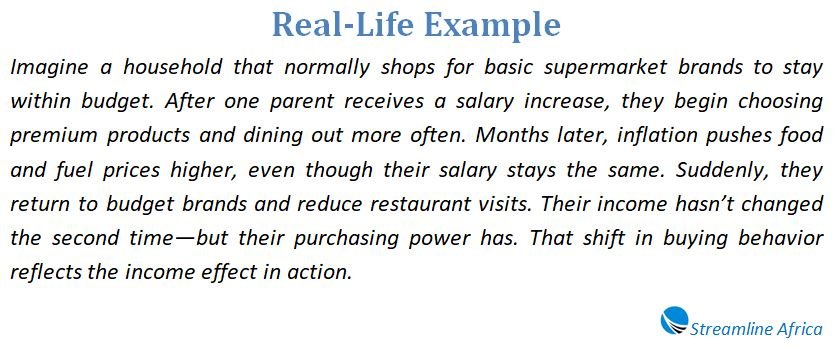

The income effect isn’t always triggered by a change in salary. Sometimes, it’s a result of changes in prices. If the cost of living drops and your income stays the same, you suddenly have more purchasing power. That can lead to increased consumption even though your paycheck hasn’t grown.

On the other hand, if prices rise—especially for necessities like food, fuel, or rent—your income may not go as far. This can make you feel “poorer” in terms of what your income can actually buy, even if your salary hasn’t changed. This subtle shift can lead you to alter your spending, like swapping out name brands for store brands or reducing how often you go out.

How the Substitution Effect Comes Into Play

Closely related to the income effect is the substitution effect. While the income effect focuses on how a change in purchasing power affects demand, the substitution effect looks at how a price change in one product can lead you to switch to a cheaper or more attractive alternative.

Let’s say the price of rice increases significantly, but pasta prices stay the same. Many consumers might switch from rice to pasta, not because they now earn more or less, but because they want better value for their money. The substitution effect leads people to replace one good with another that serves a similar purpose, especially when their budgets are tight.

Together, the income and substitution effects help explain much of consumer behavior during price fluctuations, economic booms, or downturns.

A Realistic Example of the Income Effect

Picture someone who usually buys an inexpensive sandwich for lunch but occasionally treats themselves to a gourmet hotdog. If the sandwich price rises while the hotdog remains the same, this might change how they feel about their overall spending power. Even if they can technically still afford both, the higher sandwich cost eats into their budget, making the hotdog feel like a luxury they can no longer justify.

In this case, the income effect makes the person feel poorer—despite no change in actual income—and they cut back on “treat” purchases. Over time, even these small changes in behavior ripple through larger economic trends.

Distinguishing Between Income and Price Effects

It’s easy to confuse the income effect with the price effect, but the two are distinct.

The income effect is about how a change in income (or what your income can buy) alters your demand for goods. It focuses on purchasing power and how it shifts consumer choices.

The price effect, on the other hand, is about how the cost of a specific item changing affects your decision to buy that item. While price changes can influence your perceived income, price effect deals more directly with consumer response to cost variations.

Why This Matters to Businesses and Policymakers

Understanding the income effect isn’t just helpful for consumers—it’s vital for businesses and governments. Retailers can forecast shifts in demand based on income trends, tailoring their product lines to match consumers’ changing tastes. For example, in a growing economy, stores may stock more premium goods, while during tough times, they may push value brands and lower-cost alternatives.

For governments, understanding how income affects demand can guide policies on wages, taxation, and social programs. If lower-income families are disproportionately affected by inflation, governments can step in with support like subsidies or tax credits to restore balance.

The Takehome

The income effect is a fundamental concept in economics that explains how changes in real income influence what and how much people buy. As income rises, people generally purchase more and shift toward better-quality goods. When income falls or prices rise, people become more frugal and often switch to more affordable alternatives.

This principle helps explain why a booming economy leads to surges in consumer spending and luxury purchases, while economic downturns push people toward discounts and basic necessities. It also highlights the close connection between income, prices, consumer confidence, and overall economic health.

Whether you’re managing your personal finances, running a business, or creating public policy, understanding the income effect offers a powerful lens through which to anticipate and respond to human behavior in the marketplace.

Frequently Asked Questions about the Income Effect

How does the income effect influence everyday spending?

When people feel wealthier, they may upgrade purchases—like choosing fresh vegetables over canned ones. When they feel poorer, they may switch to cheaper alternatives or reduce non-essential spending.

What are normal and inferior goods?

Normal goods are items people buy more of when they have more money. Inferior goods are budget-friendly options people turn to when money is tight but often avoid when their income rises.

How do price changes relate to the income effect?

If prices fall but your salary stays the same, your money goes further—boosting your real income. That often leads to more spending and better-quality purchases, even if your paycheck hasn’t changed.

What’s the difference between income effect and substitution effect?

The income effect is about feeling richer or poorer based on your buying power. The substitution effect is about switching to similar but cheaper products when prices rise.

Why does the income effect matter?

It helps explain how people adjust their spending as their financial situation changes. Businesses and governments use this insight to forecast trends and make better decisions during economic shifts.