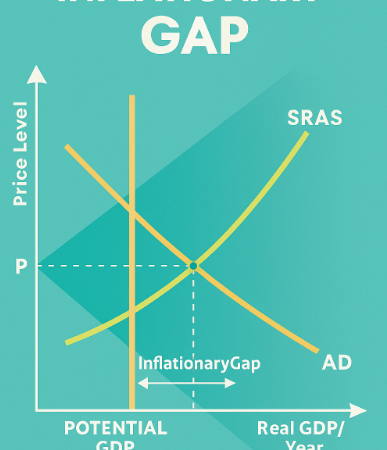

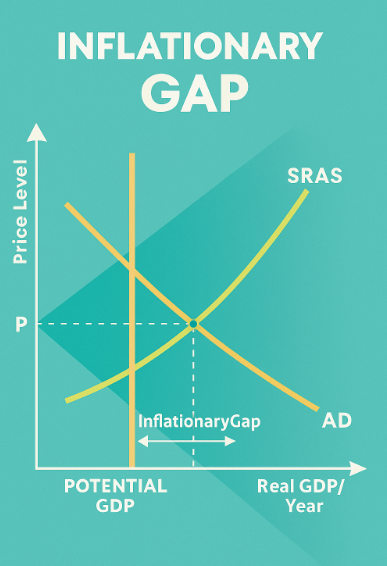

An inflationary gap happens when the economy grows faster than it realistically should. In simpler terms, it’s when people are spending and demanding more goods and services than the country is actually capable of producing sustainably. This kind of overheating can lead to price increases across the board, as businesses struggle to meet demand with their current resources.

Understanding the Dynamics

To picture it, imagine a factory running at full tilt, producing all it can with the workers and tools it has. Now, imagine customers are demanding even more than that factory can churn out. The factory can’t immediately hire more people or build more machines, so instead, prices go up. That’s essentially what an inflationary gap looks like in the broader economy. The real GDP—the value of everything the country is actually producing—is higher than the potential GDP, which represents the maximum that can be produced without straining the system.

The Formula Behind It

At its core, the inflationary gap is the difference between the real GDP (what the economy is actually producing) and the potential GDP (what it should be producing at full employment). Mathematically, it’s simply:

Inflationary Gap = Real GDP – Potential GDP

When that result is positive, the economy is experiencing inflationary pressure. When it’s negative, it’s a sign of a recessionary or deflationary gap.

What Drives the Inflationary Gap?

There are a few common triggers. One is a surge in consumer spending—maybe due to wage increases, tax cuts, or easy credit access. Another is a jump in government spending, like during infrastructure booms or major stimulus programs. Exports can also play a role; when foreign demand for domestic goods rises, producers rush to keep up. All of these factors push real GDP above potential GDP, at least temporarily.

Measuring Economic Output: Real GDP vs Nominal

Gross Domestic Product (GDP) is a key indicator of economic health. Nominal GDP tallies the total value of goods and services based on current market prices. But inflation can distort that view. That’s why economists use real GDP, which adjusts for changes in price levels to give a clearer picture of actual economic growth.

The typical formula for GDP is:

Y = C + I + G + NX

Where:

- C = Consumption

- I = Investment

- G = Government Spending

- NX = Net Exports (exports minus imports)

This result gives you nominal GDP. To convert it into real GDP, divide by a price index like the GDP deflator, which strips out the inflation factor. When real GDP consistently exceeds the potential GDP over a period, that’s a strong signal of an inflationary gap.

Managing the Gap Through Fiscal Policy

Governments have tools to bring the economy back into balance. One key approach is fiscal policy—changing how money flows in and out of the public sector. This could include reducing government spending, raising taxes, or cutting down on social payments. The goal here is to lower demand by pulling some money out of circulation.

If done right, this decreases consumer spending and cools off an overheated economy. For example, when people pay more in taxes, they have less disposable income, which can dampen demand and slow inflation.

Central Banks and Monetary Tightening

Alongside fiscal moves, central banks like the Federal Reserve can apply monetary policy to fight inflationary gaps. The main lever here is interest rates. By raising the cost of borrowing, banks discourage loans and reduce consumer and business spending.

Less access to cheap credit means fewer purchases of homes, cars, and other big-ticket items, which helps bring demand more in line with what the economy can produce. This strategy, known as “tight monetary policy,” is especially effective when inflation is being driven by excessive borrowing and consumption.

Spotting an Inflationary Gap

Identifying an inflationary gap starts with comparing real GDP to potential GDP. If actual output is running ahead of what the economy can sustainably produce, and prices are rising across many sectors, that’s a classic sign. Economists also keep an eye on employment rates. When unemployment falls below the so-called “natural rate” (where everyone who wants a job has one), it may indicate the economy is operating above its capacity, fueling inflation.

Inflationary vs Deflationary Gaps

While an inflationary gap reflects an economy doing too well, a deflationary or recessionary gap is the opposite. It’s when real GDP is below potential GDP—there’s underused capacity, high unemployment, and weak demand. Prices may fall, or grow very slowly, as businesses struggle to sell goods and services. Policymakers typically respond to recessionary gaps with stimulus measures, trying to push demand back up.

Why It Matters

An inflationary gap isn’t just a technical detail—it has real-world consequences. For everyday people, it can mean prices rising faster than wages. For businesses, it may lead to higher costs and tighter margins. And for governments, it can mean a delicate balancing act of maintaining growth while keeping inflation in check.

Policymakers walk a fine line. Cool the economy too much, and you risk pushing it into a slump. Let it run too hot, and you could end up with runaway inflation. That’s why understanding and responding to inflationary gaps is such a central part of economic management.

FAQs about Inflationary Gap

How does an inflationary gap occur?

It usually happens when people are spending more, governments increase their spending, or exports boom—pushing real GDP above what the economy can comfortably produce.

What does “real GDP is greater than potential GDP” really mean?

It means we’re overachieving economically in the short term, but it’s not sustainable. The system is stretched, and prices are rising because supply can’t keep pace with demand.

How do governments fix an inflationary gap?

They can cut spending, raise taxes, or reduce benefits—basically pulling some money out of circulation to cool things down.

What role does the central bank play?

Central banks raise interest rates to make borrowing more expensive. This slows down consumer and business spending, helping reduce inflationary pressure.

How can you tell if we’re in an inflationary gap?

If the economy is booming, unemployment is super low, and prices are rising across the board, there’s a good chance we’re in one.

What’s the opposite of an inflationary gap?

That would be a recessionary or deflationary gap—when the economy is sluggish, unemployment is high, and production is below potential.

Why should regular people care?

Because inflation affects everyone—your groceries, rent, savings, and wages. Understanding inflationary gaps helps make sense of what’s happening with the economy.

Is an inflationary gap always bad?

Not necessarily—but if left unchecked, it can lead to long-term inflation problems. It’s like revving an engine too high for too long—it might work, but it’s risky.