If you run a small business or are just starting out, you’ve likely heard the term Cost of Goods Sold (COGS) mentioned in conversations about pricing and profitability. While it may sound like a purely accounting concept, it’s far more important than that. COGS is directly tied to how efficiently you operate, how well you set your prices, and ultimately, how much profit you keep.

Knowing what COGS is and how to use it in decision-making can help you avoid costly mistakes and put your business on a stronger financial footing. Let’s break down what it means, how to calculate it, and why it should be one of your go-to metrics.

What Cost of Goods Sold Really Means

At its core, COGS is the total of all direct expenses involved in creating or delivering the products you sell. It’s the price you pay—literally and figuratively—to bring your goods from raw materials to finished products ready for sale.

These costs can include the raw materials, the wages of people directly involved in making the product, and certain overhead expenses that are strictly tied to the production process. It does not include broader operational expenses such as office rent, marketing campaigns, or administrative salaries.

For example, if you operate a chocolate factory, cocoa beans, sugar, milk, and the wages of the workers mixing and packaging the chocolates all fall into COGS. The cost of your accounting software or advertising billboards does not.

Key Components That Make Up COGS

Although COGS always relates to production costs, the specific components vary from one business to another. However, most businesses include some combination of the following:

- Raw materials and supplies – This covers the base ingredients or parts that physically make up your product, such as metal for tools, fabric for clothing, or ingredients for prepared food.

- Direct labor – The wages or salaries paid to workers who create or assemble the product, whether that’s baking bread, sewing garments, or operating manufacturing equipment.

- Production-specific overhead – Certain indirect costs still count toward COGS if they are strictly tied to manufacturing. Examples include the electricity to run production machinery or the depreciation of factory equipment.

It’s important to remember that COGS does not capture unrelated business expenses. This helps ensure you have a clear view of production efficiency without operational noise clouding the numbers.

How to Calculate COGS

There’s a standard formula for calculating Cost of Goods Sold:

COGS = Beginning Inventory + Purchases During the Period – Ending Inventory

Here’s how each part works:

- Beginning inventory – The value of goods you had in stock at the start of the accounting period.

- Purchases – The total cost of new products you bought or produced during the period.

- Ending inventory – The value of the goods that remain unsold at the end of the period.

For instance, if you run a home décor shop and start the month with $4,000 worth of stock, spend $6,000 producing or buying new items, and end with $1,500 of unsold stock, your COGS would be:

$4,000 + $6,000 – $1,500 = $8,500.

This $8,500 reflects exactly what you spent to create the goods you sold in that time frame.

Different Methods for Recording COGS

Businesses can use different inventory valuation methods to calculate and report COGS. The choice can impact your financial reports and tax obligations, so it’s not something to decide casually.

- First-In, First-Out (FIFO) – Assumes the oldest inventory is sold first. This often results in lower COGS when prices are rising, which can make profits look higher.

- Last-In, First-Out (LIFO) – Assumes the newest inventory is sold first. This can raise your COGS in times of inflation, which might lower taxable income.

- Weighted Average Cost (WAC) – Calculates an average cost for all items in stock, making it simple for businesses where inventory items are interchangeable.

The method you choose can significantly influence your profit margins and tax planning, so seeking guidance from an accountant is highly recommended.

Why COGS is More Than Just a Number

Understanding your Cost of Goods Sold offers benefits that extend far beyond simple record-keeping.

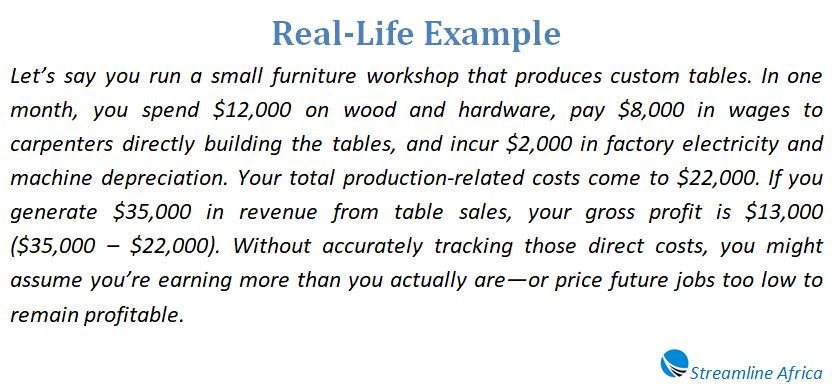

First, it helps you measure profitability. Your gross profit is calculated by subtracting COGS from total revenue, making it a direct indicator of how much money you retain after covering production costs.

Second, it informs pricing decisions. If you know precisely what it costs to produce each item, you can set prices that not only recover those costs but also generate a healthy profit.

Third, it improves inventory control. Tracking COGS helps you see which items are eating into your margins and whether you’re overproducing or overstocking slow-moving products.

Finally, COGS plays a role in financial transparency. Accurate reporting builds trust with investors, lenders, and tax authorities while helping you identify areas to improve operational efficiency.

COGS and Your Taxes

One of the often-overlooked advantages of tracking COGS accurately is its role in reducing taxable income. Since COGS is deductible, the higher your legitimate COGS, the lower your business’s taxable profit will be.

However, this only works in your favor if the calculations are precise. Overestimating could raise red flags during a tax audit, while underestimating means you might pay more tax than necessary. Careful documentation and proper accounting practices are essential.

How an Accountant Can Make the Process Easier

While business owners can certainly learn to track and calculate COGS, there’s a clear benefit to having an experienced accountant involved. They can:

- Advise on the most advantageous accounting method for your situation.

- Identify all valid costs to ensure nothing is missed or misclassified.

- Keep your tax filings compliant while optimizing your deductions.

In short, accountants free you from the burden of managing complex calculations so you can focus on running and growing your business.

Using COGS to Strengthen Your Business

When you track and understand COGS, you gain a practical tool for making better business decisions. You can adjust your prices, streamline production, and improve inventory turnover—all with the goal of increasing profitability.

Think of COGS as a health check for your business. When it’s well-managed, it reflects efficiency, smart pricing, and the ability to reinvest in growth. When it’s neglected, hidden costs can erode your profits without you even noticing.

By making COGS part of your regular financial review, you position your business to grow sustainably and stay competitive.

Frequently Asked Questions about Cost of Goods Sold

How is COGS different from other expenses?

COGS only includes costs directly tied to production, while expenses like rent, marketing, or admin salaries fall under general operating costs.

Why is COGS important for my business?

It helps you understand profitability, set competitive prices, manage inventory better, and keep financial records accurate for reporting and taxes.

What are the main components of COGS?

They usually include raw materials, wages for production staff, and manufacturing-related overheads like utilities or equipment depreciation.

How do I calculate COGS?

Use the formula: Beginning inventory + Purchases – Ending inventory. This gives the total cost of items sold in a specific period.

What methods can be used to track COGS?

Common approaches are FIFO (first-in, first-out), LIFO (last-in, first-out), and Weighted Average Cost, each affecting profit and tax differently.

Can COGS help me with pricing?

Yes. Knowing your COGS ensures you price products high enough to cover costs while still leaving room for profit.

Does COGS impact taxes?

Absolutely. Since COGS is tax-deductible, accurate calculations can reduce taxable income and help avoid paying more tax than necessary.

Should I involve an accountant for COGS?

It’s wise. An accountant can help choose the right method, ensure accuracy, and keep your tax strategy compliant and efficient.