Latest posts

-

Unlocking Employee Potential Through a Clear Development Path

Investing in employee development is one of the most strategic moves a business can make. When you nurture your team’s growth, you fuel not just individual success but also organizational progress. A well-structured development plan equips employees with the guidance and tools they need to improve, evolve, and perform at their best. Crafting a personalized…

-

Understanding Purchase Orders and Why They Matter

Every business that deals with acquiring goods or services needs a structured way to record, track, and manage those transactions. Purchase orders (POs) serve as formal documents that help ensure clarity between buyers and suppliers. While verbal agreements or casual emails can lead to confusion or disputes, a PO eliminates ambiguity by laying out the…

-

How to Create an Effective Employee Handbook That Drives Culture and Compliance

A successful business requires more than just a good product or service—it depends heavily on effective internal communication. One of the most reliable tools for establishing this communication is the employee handbook. It’s not just a formality but a strategic document that connects your staff with the core of your operations, laying out the principles,…

-

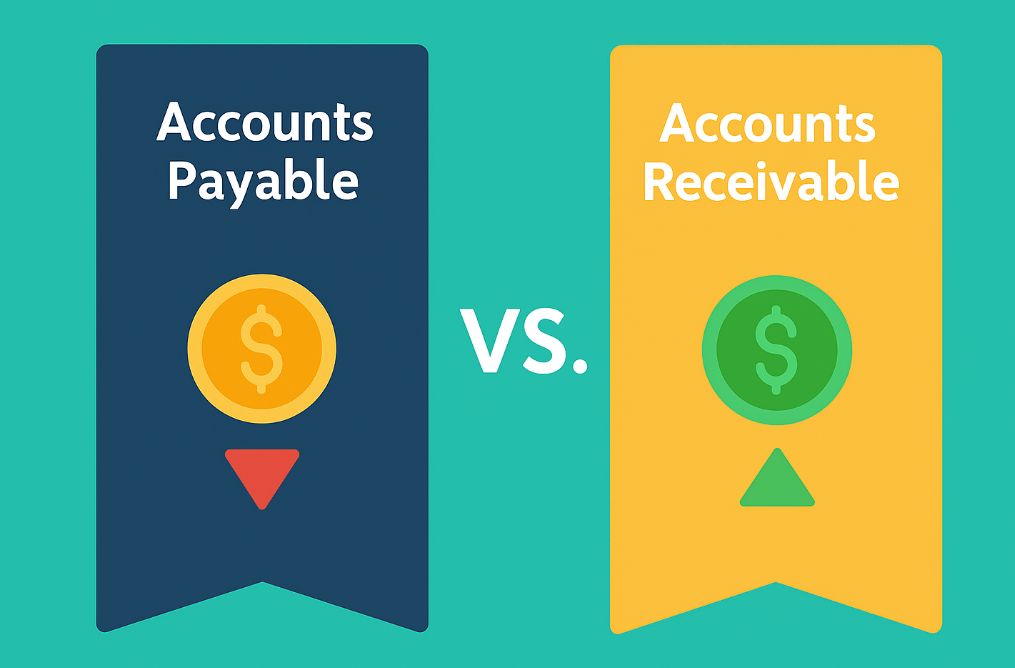

Understanding Business Transactions: Accounts Payable and Receivable Explained

For any business, whether large or small, managing cash flow efficiently is essential for sustainable growth. Two of the most important concepts that drive financial operations are accounts payable and accounts receivable. These terms define how money moves in and out of your company and have a direct impact on your bottom line. While they…

-

Avoiding Financial Pitfalls: Accounting Errors That Hinder Small Business Growth

Financial health is the backbone of any successful business. For small enterprises, managing money wisely can be the difference between growth and failure. Yet, many entrepreneurs underestimate the complexity of accounting and try to manage it themselves—often with costly consequences. This article explores the most common accounting mistakes that can limit growth, along with practical…

-

Invoice Financing Explained: Boost Cash Flow Fast Without Taking on Debt

Managing cash flow is one of the most critical aspects of running a successful business. Often, companies find themselves waiting weeks or even months for customers to settle their invoices. During that waiting period, expenses continue to accrue—wages, supplier costs, rent, and other operational needs don’t pause just because payments are delayed. Invoice financing has…

-

Understanding the Risks of Overtrading in Business

Overtrading is a silent threat to many growing businesses. While it might initially seem like a positive sign—orders coming in, demand surging—the truth is more complicated. When a company stretches its financial and operational capacity too thin, it risks running into serious difficulties that can spiral out of control. Let’s explore what overtrading really means,…

-

Smart Ways to Calculate Business Loan Payments and Choose the Right Repayment Plan

Securing a business loan can provide the capital needed to grow your company, manage operational costs, or pursue expansion plans. However, it is crucial to understand the financial responsibilities that come with borrowing. Before you accept any loan offer, make sure you know how to estimate your repayments and assess whether your business can manage…