Many business owners mistakenly use “revenue” and “income” as if they mean the same thing. While they are both key financial terms, they represent very different parts of a company’s financial picture. Knowing the difference helps ensure more accurate reporting, smarter decisions, and clearer communication with accountants, investors, and lenders.

This guide breaks down the difference between revenue and income, their uses, and how understanding both is essential for managing and growing a successful business.

What Is Revenue?

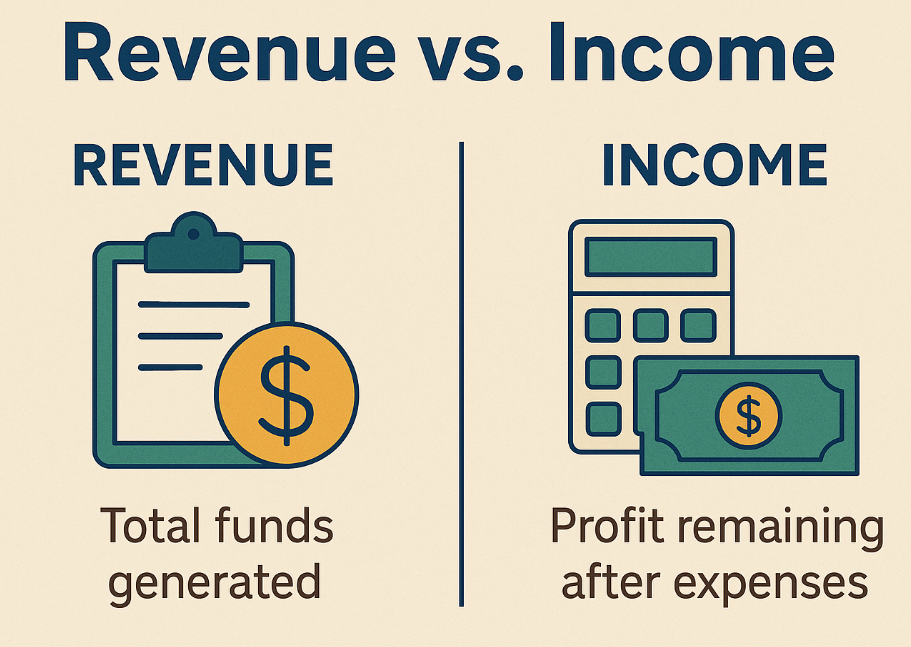

Revenue refers to the total money a company earns from selling goods or providing services during a set period. This figure is typically recorded as the first entry—called the “top line”—on an income statement.

Revenue may be generated from product sales, consulting fees, commissions, subscription models, or billable hours, depending on the business model. However, it excludes funds like loans, grants, or investment capital since those are not earned through operations.

For example:

- A freelance designer billing $5,000 worth of work in a month reports $5,000 in revenue.

- A retail store selling $40,000 worth of merchandise in a quarter earns that amount as revenue.

A high revenue total can indicate strong market demand and effective sales strategies. However, revenue alone does not determine a company’s financial health or profitability.

What Is Net Income?

Net income, also known as net profit or the “bottom line,” shows the money left over after a business subtracts all of its costs from its revenue. This includes operating expenses like payroll, rent, taxes, materials, marketing, insurance, and subscriptions.

Net income provides a clearer picture of whether a business is profitable. If expenses are greater than revenue, the business is operating at a loss. If revenue exceeds expenses, the business has net income.

This metric is often used in profit and loss statements, tax filings, and internal financial planning. Businesses with positive net income are able to reinvest, expand, or distribute earnings, while those operating at a loss must find ways to reduce costs or increase revenue.

Why the Difference Matters

Revenue and income serve different but equally important functions:

- Revenue shows the total inflow of money from business operations.

- Net income reveals how efficiently a business converts that inflow into profit.

While revenue indicates demand, net income reflects sustainability and financial control. Business owners should track both to evaluate performance and make sound decisions.

Real-Life Example: Revenue vs. Income in Action

Imagine a small service-based business that finishes a strong month, invoicing clients a total of $50,000. On paper, that looks like a win—and it is in terms of revenue. But once the month wraps up, the owner still has to pay staff wages, software subscriptions, office rent, marketing costs, insurance, and taxes. By the time all those expenses are settled, the business may be left with $8,000.

That $50,000 reflects revenue—the total amount earned from operations. The $8,000 is net income—the portion that actually stays with the business. While the revenue figure shows healthy demand and solid sales activity, the income figure reveals how efficiently the business is being run. This example highlights why strong revenue doesn’t automatically mean strong profitability—and why business owners need to watch both numbers closely.

Comparing Revenue and Income in Practice

Examples of Revenue:

- A restaurant earns $60,000 from food and drink sales in one month.

- A SaaS company receives $100,000 in recurring subscription fees over a quarter.

- A law firm invoices $75,000 in billable hours across various clients.

Examples of Income:

- That same restaurant has $45,000 in expenses, leaving $15,000 in net income.

- The SaaS company spends $80,000 on development, salaries, and infrastructure, resulting in $20,000 in profit.

- The law firm’s overhead, payroll, and admin costs total $60,000, giving it $15,000 in income.

Calculating net income is more involved than tracking revenue, as it includes variable and fixed costs like utilities, legal fees, insurance, wages, and software tools. Not all businesses incur the same expenses, so income calculations vary by size, industry, and structure.

Forms of Income on Financial Statements

Depending on how finances are reported, net income may appear under different terms:

- Net Operating Revenue

- Net Income

- Taxable Income

- Earnings Before Interest and Taxes (EBIT)

- Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)

Each format focuses on different parts of the income formula and is suited for different types of analysis, whether operational, investment-related, or tax-specific.

Practical Reasons to Know the Difference

Understanding how revenue and income differ helps with a variety of business activities:

- Business Valuation: Investors and buyers assess both top-line and bottom-line figures to gauge growth and risk.

- Loan Applications: Lenders want to see net income to ensure repayment capability, not just revenue figures.

- Tax Filings: Only net income is subject to business income tax; revenue is not.

- Strategic Planning: Revenue shows how much is being brought in, while income reveals how much stays.

- Financial Reporting: Stakeholders rely on both figures to interpret financial strength and make funding decisions.

Tracking revenue without analyzing income may give a false sense of security. Profitability depends on managing expenses in relation to earnings.

Common Misunderstandings

Many new business owners fall into the trap of assuming that strong revenue equals strong performance. However, this isn’t always the case. Companies may earn high revenue while running at a loss due to bloated costs or ineffective pricing.

Another mistake is assuming all received funds are income. Loans, investor funding, and one-time payments may increase cash flow but don’t count as revenue or income.

Furthermore, software reports may include both figures, but business owners still need to understand their meaning and apply them properly in decision-making.

How to Monitor Revenue and Income Accurately

Using modern accounting tools can help separate and clarify both revenue and income figures. Reliable platforms can:

- Track total sales and services rendered

- Categorize fixed and variable expenses

- Generate detailed profit and loss reports

- Help project future cash flow and profitability

These tools are especially useful during tax season and when seeking funding or partnerships, as they provide clean, organized financial records.

Final Thoughts

Revenue and income are foundational to understanding your business’s performance. Revenue reflects how much you’re earning through operations, while income reveals how much of that remains after covering all costs.

Tracking both allows business owners to understand where their money is coming from and where it’s going. With that insight, you can price your services more effectively, manage expenses wisely, and plan for long-term financial stability.

True success comes not just from making sales but from turning those sales into sustainable profits. By clearly distinguishing between revenue and income, you build stronger financial systems and set your business on a path toward growth.

FAQs about Income vs. Revenue

What is the main difference between revenue and income?

Revenue is the total money earned from sales before expenses, while income is what remains after all costs are deducted.

Why is it important to track both revenue and income?

Revenue shows sales performance, and income reveals profitability—both are needed to assess business health and make informed decisions.

Can a business have high revenue and still lose money?

Yes, if operating costs exceed revenue, the business can have negative income despite strong sales.

How are revenue and income used differently in accounting?

Revenue is used to measure demand and sales activity, while income is key for evaluating efficiency, profitability, and tax liability.