What Are Financial Statements?

Financial statements are formal reports that summarize how a business is performing financially and where it stands at a given point in time. They act as a roadmap for anyone who wants to understand the company’s operations, profitability, and overall stability. These reports are not just for accountants or executives—they are tools that guide investors, creditors, regulators, and even employees in making better decisions.

By presenting financial information in a structured and standardized way, financial statements allow for comparison across time and between companies. Without them, it would be nearly impossible for outside parties to evaluate whether a business is thriving, struggling, or heading toward trouble.

Why Financial Statements Matter

Think of financial statements as a health checkup for a company. Just as a doctor examines vital signs to determine physical wellness, these reports examine money flows, assets, debts, and shareholder value to reveal a business’s financial well-being. Investors use them to decide where to put their money. Lenders review them to evaluate creditworthiness. Managers rely on them to adjust strategy, while employees and analysts study them to gauge job security and growth prospects.

Financial statements are guided by rules that ensure consistency. In the United States, businesses prepare them under Generally Accepted Accounting Principles (GAAP). In many other parts of the world, the International Financial Reporting Standards (IFRS) are applied. These frameworks make sure financial data is clear, accurate, and comparable.

The Four Main Types of Financial Statements

There are four major financial statements that every company prepares: the balance sheet, income statement, cash flow statement, and the statement of shareholders’ equity. Each one tells a different part of the financial story.

The Balance Sheet: A Snapshot of Financial Position

The balance sheet, also known as the statement of financial position, provides a snapshot of what the company owns, what it owes, and what remains for shareholders at a specific point in time.

The foundation of the balance sheet is the equation:

Assets = Liabilities + Equity

This simple formula highlights how a company’s resources are financed—through debt, equity, or a mix of both.

Assets

Assets represent everything the business owns. They are divided into two categories:

- Current assets are items that can be turned into cash within a year. These include cash and equivalents, accounts receivable (money customers owe), inventory, and prepaid expenses like rent or insurance.

- Non-current assets are long-term investments such as property, plants, and equipment, along with intangible assets like patents or trademarks. They also include deferred tax assets and long-term investments.

Liabilities

Liabilities are what the business owes to others.

- Current liabilities are short-term debts due within a year, such as accounts payable, short-term loans, accrued expenses, and unearned revenue.

- Non-current liabilities are long-term obligations like bonds payable, pension liabilities, deferred tax liabilities, and long-term leases.

Equity

Equity represents the portion of the business owned by shareholders. It includes common stock, preferred stock, retained earnings, and treasury stock. Essentially, equity shows what would be left if the company sold off all assets and paid off its debts.

The Income Statement: Profit and Loss in Focus

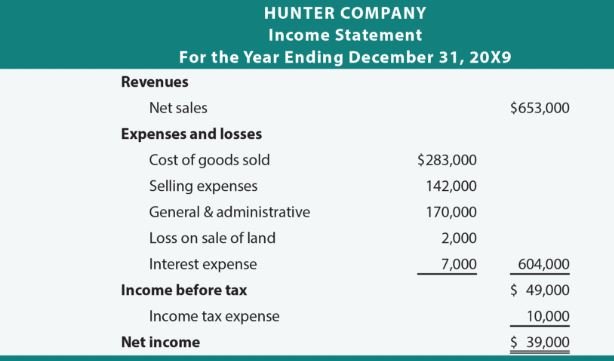

The income statement, sometimes called the profit and loss statement, covers financial performance over a period—such as a quarter or a year. It answers the most basic business question: did the company make money?

Key Components

- Revenue: The total income generated from sales or services.

- Cost of Goods Sold (COGS): The direct costs involved in producing goods or services.

- Gross Profit: Revenue minus COGS, reflecting the money left before operating expenses.

- Operating Expenses: Day-to-day costs such as salaries, rent, marketing, and utilities.

- Net Income: The final profit after accounting for all expenses, interest, and taxes.

Comparing income statements across multiple periods shows trends in profitability and efficiency. Stakeholders often use this information to judge whether management strategies are paying off.

Beyond Net Income: Comprehensive Income

While the income statement captures traditional profits and losses, some financial changes don’t show up there. That’s where comprehensive income comes in.

Comprehensive income includes items such as unrealized gains or losses on investments, foreign currency translation adjustments, pension adjustments, and hedging results. Companies may report these figures separately or as a footnote. Though easy to miss, these details provide a deeper understanding of financial reality.

The Cash Flow Statement: Tracking the Movement of Money

Unlike the income statement, which includes non-cash items like depreciation, the cash flow statement focuses purely on money moving in and out of the business. It shows how well the company manages cash to pay bills, invest, and fund operations.

Cash flow is broken into three sections:

- Operating activities: Cash from daily business activities, such as selling products and paying suppliers.

- Investing activities: Cash used for investments like buying equipment or cash earned from selling assets.

- Financing activities: Cash related to borrowing, paying off loans, or issuing stock.

This statement helps stakeholders determine whether a company generates enough cash to sustain operations or whether it relies too heavily on borrowing.

The Statement of Shareholders’ Equity: Measuring Ownership Value

The statement of shareholders’ equity tracks changes in ownership value over a period. It records how profits are retained, dividends are paid, and shares are issued or repurchased.

A positive equity balance means the company has more assets than liabilities, which is reassuring for shareholders. Negative equity could signal financial distress, potentially even insolvency. This statement is particularly useful for long-term investors who want to understand how value accumulates or erodes over time.

A Brief History of Financial Statements

Financial statements have not always been as structured and reliable as they are today. Before the 1930s, companies often issued selective financial information to attract investors, with little regulation to ensure accuracy.

The stock market crash of 1929 and the Great Depression highlighted the dangers of this lack of transparency. As a result, the U.S. government created the Securities and Exchange Commission (SEC) through the Securities Acts of 1933 and 1934, requiring public companies to publish audited financial statements.

Over time, accounting standards evolved to ensure consistency, accuracy, and comparability. Today, both national and international boards oversee these rules to promote transparency in global markets.

Limitations of Financial Statements

Although financial statements are powerful tools, they are not perfect.

- They are historical: Reports look backward and may not accurately predict future performance.

- They omit non-financial factors: Elements like employee morale, brand reputation, or customer loyalty are not reflected.

- Inflation distorts values: Assets are usually reported at historical cost, which may differ significantly from their current market value.

- Comparisons can be tricky: Differences in reporting periods, accounting methods, and assumptions can make it hard to compare companies.

Because of these limitations, financial statements should be read alongside other sources of information, such as industry analysis and market trends.

How to Read Financial Statements Effectively

Reading financial statements is a skill anyone can learn with practice. Here’s how to approach them:

- Balance Sheet: Focus on assets versus liabilities to understand stability. Look at liquidity ratios to see if the company can meet short-term obligations.

- Income Statement: Study revenue trends and expense patterns. A steady increase in net income usually signals effective management.

- Cash Flow Statement: Pay attention to whether operating cash flow is positive, as this indicates sustainability.

- Shareholders’ Equity: Observe changes over time to see how value is being built or diminished.

By connecting insights from all four statements, you gain a holistic picture of a company’s financial health.

Are Financial Statements Universal?

Yes and no. While the structure of financial statements is largely the same worldwide, the rules that govern them differ. U.S. companies use GAAP, while many other countries follow IFRS. The differences can affect how numbers are reported, so international investors must be aware of the standard a company uses.

Why Financial Statements Are Crucial

Financial statements are more than just reports—they are essential tools for decision-making. Investors rely on them to judge whether a company is worth buying into. Creditors use them to assess whether loans can be repaid. Managers use them to refine strategy. Regulators and analysts turn to them for transparency and accountability.

In short, financial statements are the language of business. Understanding how to read them provides insight into whether a company is healthy, risky, or primed for growth.

The Bottom Line

Financial statements play a central role in modern business. The four key reports—balance sheet, income statement, cash flow statement, and statement of shareholders’ equity—each tell a different part of the company’s financial story.

Learning to interpret these statements gives you the ability to evaluate companies more accurately, whether you are an investor, a business leader, or simply someone curious about financial literacy. By combining the insights from these reports with an understanding of broader economic and market trends, you gain a clearer view of where a company stands today and where it might be headed tomorrow.

Frequently Asked Questions about Financial Statements

Why are financial statements important?

They allow investors, managers, creditors, and even employees to evaluate how stable and profitable a company is, helping guide investment or business decisions.

What are the main types of financial statements?

The four key reports are the balance sheet, income statement, cash flow statement, and statement of shareholders’ equity. Each reveals different aspects of financial performance.

How does a balance sheet work?

A balance sheet lists assets, liabilities, and equity at a specific date. It follows the formula: Assets = Liabilities + Equity, showing what a company owns versus what it owes.

What does the income statement reveal?

It details revenue, expenses, and net income over a set period, essentially answering whether the company made a profit or suffered a loss.

Why is the cash flow statement useful?

It tracks how money moves in and out of the business through operations, investing, and financing, showing whether the company generates enough cash to sustain itself.

What is the statement of shareholders’ equity?

This statement outlines how ownership value changes over time, reflecting retained earnings, stock issuance, or buybacks, and gives insight into long-term stability.

Are financial statements the same worldwide?

The core idea is the same, but rules differ. U.S. companies use GAAP, while many international firms follow IFRS, making global comparisons sometimes tricky.

What are the limitations of financial statements?

They report past performance, don’t reflect things like brand reputation or employee morale, and may vary due to accounting estimates, making them only part of the big picture.

How can learning to read financial statements help you?

It sharpens financial literacy, helps spot opportunities or risks, and empowers better decisions—whether you’re an investor, entrepreneur, or just financially curious.