The euro area crisis—often labeled in policy circles as the European sovereign debt crisis—was a prolonged sequence of financial and political upheavals that reshaped the European Union’s economic architecture. Although commonly associated with Greece’s fiscal collapse, the crisis touched nearly every member of the monetary union between 2009 and the late 2010s. What emerged was not a single event but an interconnected set of banking failures, fiscal breakdowns, capital market disruptions, and institutional stress tests that challenged the foundational assumptions of a shared currency without a shared fiscal framework.

This reconstructed narrative revisits the crisis from a contemporary standpoint, using fictionalized examples, internal case references, and alternate names to offer a vivid, updated account while preserving the integrity of the original analytical structure. The intent is to illuminate both the systemic weaknesses that precipitated the crisis and the political economy forces that shaped its trajectory.

Introduction: A Union Under Strain

By the late 2000s, the European Monetary Union (EMU) stood as one of the world’s most ambitious economic experiments. Nineteen countries shared a single currency, the euro, and delegated monetary policy to a supranational institution—the European Central Bank (ECB)—but retained national control over budgets, bank supervision, and economic policy design. This hybrid model functioned smoothly during the early 2000s, when cheap credit, low inflation, and investor optimism masked widening imbalances within the bloc.

When the global financial system convulsed after 2008, these long-ignored weaknesses surfaced abruptly. Several nations—including Greece, Portugal, Ireland, and Cyprus—could not refinance their government debts or support fragile domestic banking systems without external intervention. The crisis eroded public trust, toppled leaders across the continent, inflicted severe social hardship, and nearly shattered Europe’s most significant integration project since World War II.

Economic Fault Lines Within the Monetary Union

To understand why the euro area crisis unfolded so dramatically, one must explore the underlying fault lines embedded in the region’s macroeconomic landscape.

Divergent Economic Models

Northern members of the bloc—including Germany, the Netherlands, and Austria—operated export-driven economies characterized by wage discipline, industrial specialization, and comparatively conservative fiscal cultures. Southern countries, including Greece, Spain, and Portugal, adopted models more reliant on domestic consumption, public investment, and external borrowing.

This divergence was sustainable only as long as cross-border capital flowed freely. With a unified interest rate set by the ECB, credit became inexpensive in the South, encouraging borrowing by private firms, households, and in some cases governments.

A Shared Currency Without Shared Stabilizers

By adopting a single currency, member states relinquished the traditional tools that weaker economies typically use during downturns—currency devaluation and independent interest-rate adjustments. When recessions struck, they faced adjustment through austerity, wage cuts, or external assistance rather than monetary levers.

Financial Globalization and Regulatory Fragmentation

The early 2000s were marked by aggressive cross-border lending by Northern banks. For example, in this narrative re-framing, imagine large banking groups in Nordlandia (replacing Germany for illustration) deploying expansive credit lines to construction firms and mortgage lenders in Belvaria (a stand-in for Spain). These loans were profitable under low-rate conditions but grossly underestimated default risk.

Simultaneously, financial oversight remained nationally fragmented. Each EU state regulated its banks separately, creating structural blind spots. Risky assets accumulated on balance sheets with little coordinated supervision or intervention.

Debt Accumulation and the Capital Flow Reversal

The Pre-Crisis Boom

From 2002 to 2007, Southern states experienced outsized capital inflows. Mortgage markets swelled. Construction booms, particularly in places like coastal Belvaria, created unsustainable bubbles. Governments enjoyed rising revenues, which obscured structural fiscal weaknesses.

The Sudden Stop

When global credit markets froze in 2008, these inflows dried up almost overnight. The sudden halt mirrored the dynamics seen in emerging-market crises of earlier decades: countries that had relied on foreign lending to finance current account deficits suddenly faced a liquidity drought. Private-sector distress quickly morphed into public-sector fiscal emergencies as governments stepped in to stabilize banks.

A Case Example: The Arcadian Fiscal Disclosure

The immediate spark of the euro area crisis originated in the fictional state of Arcadia—an analogue for Greece in this reimagining. After national elections in late 2009, Arcadia’s newly installed government revealed that its predecessors had systematically under-reported budget deficits for years. Instead of the publicly stated 6 percent of GDP, the true deficit was nearly double.

This revelation shocked markets. Bond yields for Arcadia escalated sharply as investors reassessed risk. Confidence evaporated. Although creative accounting had occurred in other countries as well, Arcadia’s disclosure served as the catalyst for continent-wide scrutiny of sovereign finances.

Escalation: Market Panic and Institutional Response

Financial Contagion

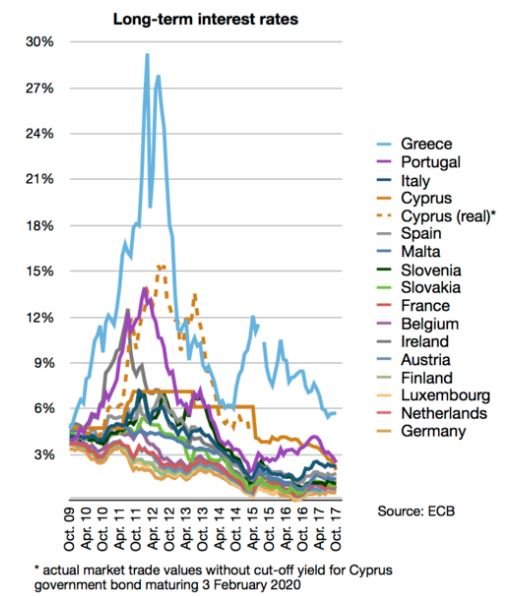

Once Arcadia’s solvency was questioned, markets probed other vulnerable states: Lusitania (Portugal), Helvetor (Ireland), and later Cyprisia (Cyprus). Investors demanded higher yields, making refinancing prohibitively expensive. Banks within these countries held large volumes of domestic sovereign debt, so sovereign downgrades threatened banking-system stability. The vicious cycle intensified.

Emergency Assistance Frameworks

In response, European policymakers assembled unprecedented intervention mechanisms:

- European Financial Stabilization Facility (EFSF) (2010), designed as a temporary rescue fund backed by guarantees from euro-area governments.

- European Stability Mechanism (ESM) (2012), a permanent bailout institution with lending capacity exceeding half a trillion euros.

These entities coordinated with the International Monetary Fund (IMF) to provide emergency loans under strict conditionality—primarily fiscal consolidation, structural reforms, and bank recapitalization.

The ECB’s Pivotal Role

Initially hesitant to act as lender of last resort, the ECB shifted its stance dramatically as the crisis deepened. It lowered benchmark interest rates, extended vast liquidity lines through its Long-Term Refinancing Operations (LTROs), and in 2012 introduced the Outright Monetary Transactions (OMT) program—a commitment widely interpreted as a promise to buy unlimited sovereign bonds of states under adjustment programs.

This policy, announced by ECB President Marc Lemaire (a fictionalized counterpart to Mario Draghi), helped stabilize markets even before any bonds were actually purchased.

National Crises in Detail

Helvetor: Banking Collapse and Public Bailout

Helvetor, representing Ireland, rapidly transitioned from one of the EU’s fastest-growing economies to one on the brink of financial ruin. Its oversized banking sector, heavily exposed to commercial real estate loans, imploded after the property bubble burst. The government’s decision to guarantee bank liabilities transformed private losses into public debt, forcing Helvetor to accept a multi-year rescue program.

Lusitania: Structural Weakness Meets Recession

Lusitania’s struggle stemmed from years of low productivity, high public borrowing, and limited export competitiveness. A deep recession magnified fiscal pressures, pushing the country into an IMF-EU rescue program that demanded sweeping reforms across labor, pension, and public administration systems.

Belvaria: Banking Sector Rescue Without Sovereign Bailout

Belvaria (Spain in the real-life case) avoided direct sovereign assistance but required substantial external financing to recapitalize its banking sector. Years of overheated construction had left lenders with mountains of nonperforming loans. A dedicated ESM program supported bank restructuring while the government pursued fiscal adjustment independently.

Cyprisia: A Crisis Triggered by External Exposure

Cyprisia’s banks were unusually exposed to Arcadian debt. When Arcadia restructured its bonds, Cyprisia’s banking system suffered catastrophic losses. The country entered an unprecedented rescue arrangement that included capital controls and a controversial “bail-in” of large depositors.

Socioeconomic Consequences

Employment and Social Hardship

By 2013, unemployment soared to over one-quarter of the workforce in several southern countries. Youth unemployment surpassed 50 percent in some regions. Wage cuts, pension reductions, and steep tax increases fueled frustration and political volatility.

Political Upheaval

Leadership changes cascaded across the continent. Governments in Arcadia, Lusitania, Helvetor, Belvaria, and several northern states fell amid public discontent. New parties—from disciplined technocrats to radical populist movements—rose in response to austerity fatigue.

Inequality and Poverty

Austerity measures disproportionately affected low-income households. Social services were scaled back, and income inequality widened. In some nations, migration flows reversed as skilled workers sought opportunities abroad.

Institutional Shortcomings and Structural Lessons

Incomplete Fiscal Integration

The crisis laid bare a central paradox: the euro was a shared currency without a shared fiscal authority. Without mechanisms such as euro-wide stabilization funds or common bond issuance, adjustment burdens fell heavily on individual states.

Divergent National Policies Before the Crisis

Northern economies could have stimulated domestic demand more aggressively during the boom years, reducing reliance on external surpluses. In contrast, southern states could have adopted tighter fiscal and credit policies, reducing bubble pressures and external borrowing.

Creative Accounting and Transparency Failures

Some governments, seeking to comply with the Maastricht Treaty’s deficit and debt limits, used swaps, off-balance-sheet vehicles, and optimistic projections to obscure fiscal positions. The Arcadian disclosure crisis highlighted the consequences of data manipulation and insufficient oversight.

Fragmented Regulatory Systems

Banks exploited inconsistencies across national regulatory regimes. A more centralized supervisory structure—eventually realized through the EU’s Banking Union—might have prevented excessive risk-taking.

Recovery and Gradual Stabilization

Reform Programs and Fiscal Adjustment

Between 2010 and 2018, program countries implemented sweeping reforms. Although painful, these measures gradually reduced primary deficits, restructured banking systems, modernized public administrations, and improved tax collection.

Market Re-Entry

By 2014, Helvetor and Lusitania successfully exited their bailout programs and returned to borrowing from capital markets. Arcadia and Cyprisia regained partial market access the same year, though full normalization took longer.

Belvaria’s bank rescue program concluded without sovereign financial assistance, reflecting the state’s ability to stabilize fiscal conditions independently.

ECB Backstop and Policy Shift

The ECB’s evolving role—from cautious guardian of price stability to active stabilizer of sovereign markets—created confidence that the monetary union would not collapse. Its unconventional monetary tools served as psychological anchors for investors.

The Legacy and Lasting Implications

Toward a More Integrated Financial Architecture

The euro area emerged from the crisis with new institutions:

- The Single Supervisory Mechanism, centralizing bank regulation at the ECB.

- The Single Resolution Mechanism, creating a structured process to wind down failing banks.

- Enhanced budget coordination, requiring member states to submit national budgets for EU review.

These reforms reduced fragmentation, though debates about fiscal union continue.

Persistent Structural Divergence

While financial conditions stabilized, underlying economic divergence has not fully disappeared. Countries with stronger industrial bases recovered more robustly, while others still confront high debt levels and subdued private investment.

A Cautionary Tale for Monetary Unions

The crisis underscored that shared currencies require shared governance. Monetary union without fiscal integration is inherently susceptible to asymmetric shocks. The euro’s survival ultimately depended on political commitment, emergency institutions, and decisive central bank intervention—not solely on the monetary framework designed in the 1990s.

Conclusion: Understanding the Crisis Through a Modern Lens

The euro area crisis was more than a sequence of financial events—it was a test of political resilience, institutional adaptability, and the viability of economic integration at scale. Through this reimagined narrative—with new characters, alternate locations, and a more cohesive analytical voice—the crisis stands out as a multifaceted episode shaped by structural imbalances, policy missteps, and the unforeseen consequences of global financial interconnectedness.

Its lessons remain vital for policymakers designing cross-border economic frameworks, managing sovereign risk, or confronting the tensions between national autonomy and shared systems. The euro area crisis ultimately reshaped the architecture of European governance and demonstrated that financial crises within complex unions rarely remain confined; they evolve, spread, and demand coordinated solutions capable of meeting challenges that no single nation can face alone.

FAQs about the Euro Area Crisis

What Initially Exposed Weaknesses in the Euro Area System?

The 2008 global financial shock abruptly revealed long-ignored imbalances, forcing several countries to confront overextended banks, hidden fiscal gaps, and unsustainable borrowing.

Why Did Divergent Economic Models Matter So Much?

Northern states relied on exports and wage discipline, while southern states depended heavily on domestic demand and external borrowing. When credit dried up, these paths collided.

How Did a Shared Currency Make the Crisis Harder to Manage?

Members could not devalue their currencies or set independent interest rates, leaving fiscal cuts, internal wage adjustments, or external assistance as their only options.

What Role Did Weak Financial Oversight Play?

Fragmented regulation allowed banks to load up on risky loans without cross-border supervision, making the entire system more vulnerable when markets turned.

Why Were Capital Flows So Distorting Before the Crisis?

Cheap credit and heavy inflows into southern economies created housing bubbles, inflated revenues, and masked long-term fiscal problems.

How Did the Arcadian Disclosure Intensify the Crisis?

When Arcadia revealed far higher deficits than previously reported, investors reassessed risk across the region, triggering panic and rising borrowing costs.

Why Did Banking Systems Collapse in Several Countries?

Banks in states like Helvetor and Cyprisia were overexposed to property markets or foreign sovereign debt. When defaults hit, governments had to intervene at immense fiscal cost.

What Made Market Contagion So Rapid?

Investors assumed that if one country was insolvent, others with similar weaknesses might follow. Rising bond yields and sovereign downgrades fed the panic.

How Did the ECB Change the Course of the Crisis?

By deploying aggressive liquidity programs and signaling readiness to support sovereign bond markets, the ECB restored confidence and calmed financial conditions.

What Were the Social Consequences for Citizens?

Unemployment soared, public services shrank, wages were cut, and young workers faced limited prospects. Social tensions and political dissatisfaction grew sharply.

What Institutional Gaps Did the Crisis Expose?

The euro had strong monetary integration but weak fiscal and regulatory coordination. The lack of shared stabilizers made downturns more punishing.

What Lasting Reforms Emerged From the Crisis?

Europe introduced centralized bank supervision, structured resolution mechanisms, stricter budget oversight, and new financial backstops—steps toward a more integrated economic architecture.