Supply-side economics is a school of thought that places the producer at the center of economic growth. It argues that when businesses and entrepreneurs are empowered to create more goods and services, the entire economy benefits. The theory suggests that reducing taxes, easing regulations, and stabilizing monetary conditions stimulate innovation, expand investment, and generate employment opportunities.

This approach became especially popular in the 1980s under U.S. President Ronald Reagan, whose policies earned the nickname “Reaganomics.” The philosophy was that encouraging the wealthy and business owners to expand their activities would ultimately help workers and consumers, as the economic benefits would cascade through society.

The Core Belief of Supply-Side Economics

At its heart, this theory argues that supply—or the ability to produce—matters more than demand in driving economic performance. While Keynesian economists see consumer spending as the lifeblood of growth, supply-siders believe that sustainable expansion only happens when producers are incentivized to innovate, invest, and create.

This view stems from the principle that production naturally creates its own demand. If more goods are available, prices tend to fall, making them more affordable. As a result, people buy more, and the economy grows. Supporters often sum it up with the phrase: “you can’t consume what hasn’t been produced.”

Contrasting Keynesian and Supply-Side Approaches

One of the clearest ways to understand supply-side economics is by comparing it to Keynesian economics. Keynesians believe that when demand drops—such as during a recession—the government must step in with public spending and loose monetary policy to reignite growth. For them, boosting demand restores balance.

Supply-siders, on the other hand, argue that consumer demand is not the main driver. They insist that when producers are given room to operate, they will generate jobs, reduce costs, and expand the range of goods available. In this view, supply lays the foundation for growth, while demand follows.

The Idea That Supply Generates Its Own Demand

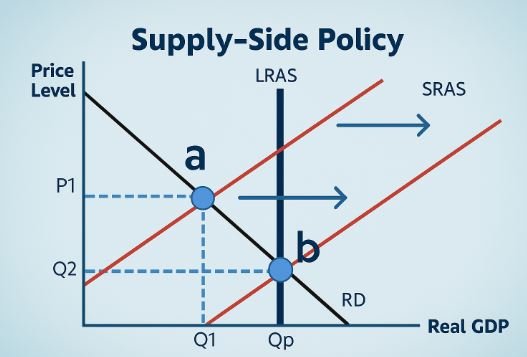

A central claim of this theory is tied to the concept of equilibrium. If companies produce more goods than consumers initially want, prices will decline. Lower prices encourage more buying, clearing the surplus. Conversely, when production falls short, prices rise, motivating businesses to produce more.

Supporters of this theory often simplify the economy with a nearly vertical supply curve. In their model, additional demand mainly pushes prices upward without significantly affecting the amount of output. Only changes in supply—such as improved productivity, investment, or tax reductions—truly expand the economy’s capacity to grow.

The Three Pillars of Supply-Side Economics

Although often associated only with tax cuts, supply-side economics is built on three main pillars: tax policy, regulatory policy, and monetary policy. Each plays a unique role in shaping the conditions under which businesses operate.

Practical Example

Government reduces corporate taxes and simplifies business regulations to encourage investment. In response, a manufacturing company expands its factory, purchases new machinery, and hires more workers to increase production. The additional output lowers unit costs and allows the firm to offer goods at more competitive prices. As employment rises and wages are paid, households gain income and spend more, indirectly stimulating the wider economy—demonstrating how production-focused policies can drive growth from the supply side.

Tax Policy

Reducing taxes is one of the most recognizable aspects of this theory. Advocates believe that lower income taxes encourage individuals to work more and take risks, while lower capital gains taxes motivate investors to channel money into productive ventures.

Some even argue that cutting taxes doesn’t necessarily reduce government revenue. The reasoning is that a stronger economy with more jobs and higher productivity enlarges the tax base, potentially offsetting lower rates.

Regulatory Policy

Supply-siders also emphasize the importance of a business environment free from excessive rules. Heavy regulations, they argue, slow down innovation, discourage entrepreneurship, and increase costs for both businesses and consumers. By keeping government involvement limited, companies can respond more quickly to opportunities and invest with confidence.

This perspective aligns closely with traditional conservative views, which often favor smaller government and freer markets.

Monetary Policy

The role of money supply and interest rates is more controversial. Supply-side theorists generally see monetary policy as a background factor rather than a direct driver of growth. They warn that too much government interference—such as excessive printing of money—leads to inflation, while overly tight policies can choke growth.

Instead of using monetary policy as a lever for frequent adjustments, supply-siders prefer stability. A predictable money supply, modest inflation, and reliable currency value are seen as essential for long-term planning and investment.

The Gold Standard Debate

An interesting feature of supply-side thought is its occasional connection to the gold standard. Advocates argue that tying the dollar to gold would bring stability, preventing governments from manipulating currency to solve short-term problems. Gold is viewed as a steady store of value, making it an anchor that can limit inflation and currency fluctuations.

While many mainstream economists see this as outdated, supply-siders often point to gold prices as a signal of investor confidence in the dollar. In their view, when gold prices rise, it can serve as a warning of potential inflation or instability in monetary policy.

Why It’s Called Supply-Side Economics

The name itself highlights the emphasis on production. The theory claims that the supply of goods and services is the true engine of prosperity. Without production, there is nothing to trade, consume, or invest in. This is the opposite of demand-focused theories, which prioritize consumption and government spending.

Reaganomics and the Supply-Side Revolution

Supply-side economics became a household term during the Reagan presidency in the 1980s. Reagan embraced tax cuts, deregulation, and increased defense spending, arguing that these measures would unleash private sector growth.

Critics accused the policies of favoring the wealthy while increasing deficits, but supporters credited them with revitalizing the American economy after a decade of high inflation and sluggish growth. The debate over the success of Reaganomics continues to this day, but its influence on U.S. economic policy remains undeniable.

Criticisms of Supply-Side Economics

Despite its popularity in certain political circles, supply-side economics has faced heavy criticism. Opponents argue that the promised “trickle-down” effects often fail to materialize. Instead of reinvesting tax savings into job creation, wealthy individuals and corporations may simply accumulate more wealth.

Others point out that large tax cuts have often contributed to ballooning government deficits, forcing future generations to bear the burden. Critics also argue that supply-side policies can widen income inequality by disproportionately benefiting high earners.

Supporters’ Counterarguments

Supporters push back by saying critics overlook the broader picture. They argue that when businesses have more resources, they expand production, hire workers, and contribute to technological progress. Over time, the benefits filter into higher wages, lower prices, and better opportunities for all.

They also stress that supply-side economics is not about instant fixes but about creating conditions for long-term prosperity. By prioritizing production, innovation, and investment, they believe economies become more resilient and capable of sustainable growth.

Modern Perspectives on Supply-Side Economics

Today, supply-side ideas still influence economic debates around the world. Some countries adopt elements of the theory when aiming to attract investment, boost competitiveness, or reduce unemployment.

For instance, governments often cut corporate taxes or streamline regulations to encourage businesses to set up operations locally. Even critics acknowledge that elements of supply-side thinking, when balanced with demand-side measures, can play a role in shaping robust economies.

Balancing Supply and Demand Approaches

Few economists today advocate for a purely supply-side or purely demand-side system. Instead, most recognize that both producers and consumers matter. A healthy economy requires businesses willing to innovate and expand, alongside consumers who have the purchasing power to buy what is produced.

Blending the two approaches often creates more stability. For example, tax incentives may encourage companies to invest, while targeted government spending can ensure consumer demand remains strong enough to support production.

Conclusion: The Ongoing Debate

Supply-side economics has left a lasting imprint on economic thought and policy. Its emphasis on production, tax cuts, and deregulation shaped major political movements and continues to fuel debates on how best to promote growth.

While critics see it as favoring the wealthy and deepening inequality, supporters argue it unleashes entrepreneurial energy and builds the foundation for prosperity. Whether one embraces or rejects it, supply-side economics remains a key lens through which to view the complex dance of policy, production, and growth.

FAQs about Supply-Side Economics

How does supply-side economics differ from Keynesian economics?

Keynesian economics emphasizes consumer demand as the key driver of growth, while supply-side economics stresses production. Keynesians see government spending as a solution during recessions, whereas supply-siders believe empowering producers is the path to recovery.

Why is it linked to Ronald Reagan?

The approach gained popularity in the 1980s under President Ronald Reagan, whose policies of tax cuts and deregulation became known as “Reaganomics.” These policies were grounded in supply-side thinking.

What are the three pillars of supply-side economics?

The theory rests on tax policy, regulatory policy, and monetary policy. Lower taxes encourage work and investment, fewer regulations support business activity, and stable monetary conditions create confidence for long-term planning.

What does it mean when supply creates its own demand?

The theory suggests that when businesses produce more, prices fall, making goods more affordable. As a result, consumers buy more, which balances the economy. In this way, production naturally generates its own demand.

Why do some supply-siders favor the gold standard?

They see gold as a stable anchor for currency. By tying money to gold, governments would have less power to manipulate the money supply, reducing inflation and currency instability.

What criticisms does supply-side economics face?

Critics argue that the benefits often flow mostly to the wealthy, widening inequality. Others say tax cuts have sometimes worsened budget deficits instead of creating the promised economic boom.

Why does it still matter today?

Even though it’s controversial, many governments still use parts of supply-side theory. Policies like lowering corporate taxes or reducing regulations are common strategies to attract investment and encourage growth.