Understanding Working Hours and Overtime in Ghana

In Ghana, employment regulations ensure that labor conditions are clearly defined, especially in terms of how long employees are expected to work. The number of hours an individual should work is typically set out in internal company guidelines or rules, aligning with broader labor laws. When an employee goes beyond these stipulated hours, it is typically classified as overtime.

Overtime work is recognized when employees continue working past the set schedule agreed upon by the employer and the employee. However, the law does make room for exceptions. In rare or emergency situations—such as when a business is in danger of collapsing or when human lives are at risk—employers may require employees to extend their working hours without additional compensation. These situations are considered extraordinary and not part of routine operations.

This framework ensures a balance between workers’ rights to rest and the need for flexibility during unforeseen circumstances. While it safeguards workers from being overburdened, it also allows for critical operations to continue when necessary.

How Ghana Calculates Monthly Minimum Wage

The minimum wage in Ghana is structured primarily around daily rates, which are established by the National Tripartite Committee. For monthly earnings, a standard conversion formula is used. In most cases, the monthly wage is determined by multiplying the daily minimum wage by 27. This figure is widely accepted as a practical monthly equivalent based on typical work patterns in Ghana.

This method ensures uniformity and clarity in calculating wages for both employers and employees. Whether an individual works in a full-time role or a casual labor arrangement, this consistent formula allows for equitable computation of monthly pay. It also serves as a useful tool for regulatory bodies to monitor compliance across different industries and sectors.

Defining the Minimum Wage in Ghana

Ghana has instituted a legally binding minimum wage system. This national wage floor is the lowest amount an employer can legally pay an employee for a day’s work. The aim is to provide financial protection for all workers and ensure they earn enough to meet basic living standards.

Regardless of the size of the enterprise or the nature of employment, no worker in the country should receive less than the government-mandated minimum wage. This regulation applies to all sectors, including informal work settings, and acts as a safety net for vulnerable workers who might otherwise be subject to exploitation.

To reinforce compliance, there are legal consequences for businesses or employers that pay less than the prescribed rate. These can include fines, sanctions, or other punitive measures enforced by Ghanaian labor authorities. The policy strengthens the labor market by promoting fair compensation and reducing income inequality.

Wage Conversions: From Hourly and Weekly to Monthly Pay

For employees whose wages are calculated by the hour or week, Ghana has standardized formulas for converting these figures into monthly salaries. If a worker is paid on a weekly basis, the monthly income is calculated by multiplying the weekly wage by 4.33. This multiplier represents the average number of weeks in a month and provides a realistic approximation of monthly earnings.

In situations where an employee is compensated based on hourly rates, the conversion takes into account the number of standard work hours per week. The total number of weekly hours is multiplied by 4.33 to obtain the monthly total. These formulas ensure fairness and accuracy when translating different wage formats into monthly income figures, allowing both employers and employees to budget effectively.

Public Holiday Compensation and Legal Rights

According to Ghana’s Labour Act (Act 651), workers are entitled to full payment on recognized public holidays. This means that if a national or statutory holiday falls on a day when an employee would normally work, they are still entitled to receive their regular wages, even if they do not perform any duties on that day.

This legal provision ensures that workers are not financially disadvantaged by observing national holidays. It reflects Ghana’s commitment to protecting labor rights while promoting national unity and rest during significant cultural and historical observances.

Ensuring Fair Labor Practices in Ghana

Ghana’s labor laws are designed to uphold dignity and equity in the workplace. By setting clear guidelines for working hours, overtime, and compensation, the government aims to create a stable and just environment for all workers. The existence of a national minimum wage serves as a critical element in this system, offering a guaranteed level of income across diverse employment sectors.

The enforcement of these laws, coupled with ongoing monitoring by labor inspectors and government agencies, ensures that employers meet their obligations. Workers who believe they have been treated unfairly have avenues to report grievances and seek redress, contributing to a transparent and accountable labor system.

Frequently Asked Questions about Ghana’s Minimum Wage

What is the standard method for calculating monthly minimum wage in Ghana?

Monthly minimum wage is calculated by multiplying the daily minimum wage by 27 days.

When is overtime applicable in Ghana?

Overtime is applicable when a worker goes beyond the official working hours set by their organization’s rules.

Are there exceptions where overtime work may not be paid?

Yes, in exceptional situations like emergencies threatening human life or the survival of the business, extra work may not be compensated.

What is Ghana’s approach to setting minimum wages?

Ghana has a legally mandated national minimum wage that no employer is allowed to pay below.

Can employers be penalized for paying less than the minimum wage?

Yes, employers who fail to comply with the minimum wage law may face penalties or sanctions from the government.

How is monthly pay calculated for weekly wage earners?

For workers paid weekly, monthly pay is calculated by multiplying the weekly wage by 4.33.

How are hourly wages converted to monthly salaries?

Hourly wages are converted to monthly pay by multiplying the standard weekly hours by 4.33.

Are workers entitled to pay on public holidays?

Yes, under Ghana’s Labour Act, employees must be paid their full wages on public holidays.

Who determines the minimum wage in Ghana?

The National Tripartite Committee, made up of government, employer, and labor representatives, sets the national minimum wage.

Does the minimum wage apply to all sectors?

Yes, it applies to both formal and informal sectors, covering all categories of workers.

What protects workers from being underpaid?

The legal framework and enforcement mechanisms in Ghana ensure employers comply with the minimum wage and labor standards.

Why does Ghana use 4.33 for monthly wage conversion?

The 4.33 multiplier reflects the average number of weeks in a month, allowing consistent monthly wage calculations.

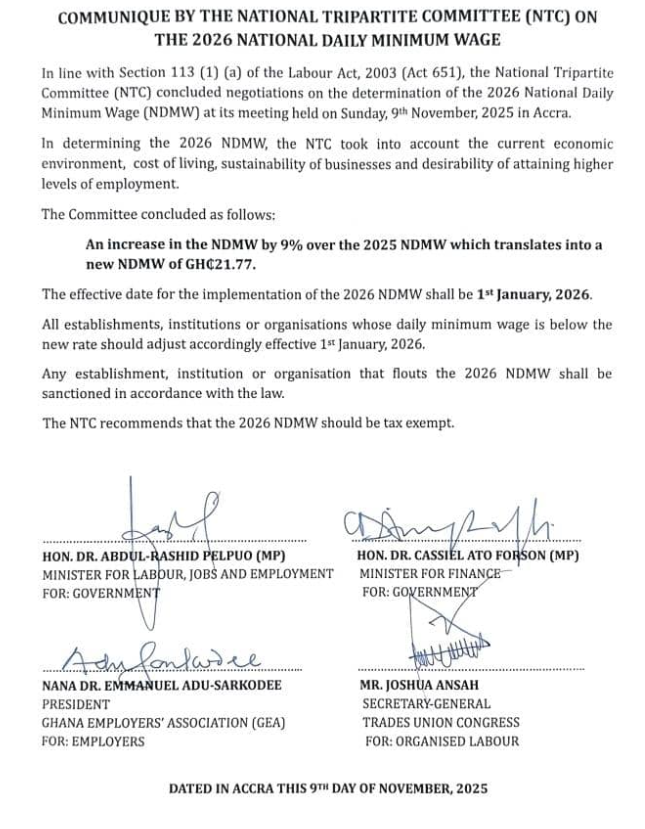

What is the current minimum wage in Ghana?

Following a November 2025 meeting in Accra, Ghana’s National Tripartite Committee raised the daily minimum wage to GH₵21.77, marking a 9% increase. So this means that the monthly minimum wage for an employee should be GH₵ 587.79 (GH₵21.77 * 27 Days).